Ecosystem Index Tokens (Primer)

Overview & Methodology for all of Amun's Ecosystem Tokens

Thesis

As with traditional finance, savvy investors often prefer to invest in indices or “baskets” such that their risk to any individual asset is mitigated by the basket’s other constituents. Many retirement plans use a blend of indices based on an individual’s age-adjusted risk tolerance, changing the composition as time elapses and the investor nears retirement. Exchange-traded products (ETPs) – like 21Shares’s Bitcoin ETP – mirror the performance of one or more underlying assets. Index funds tend to outperform individual investment vehicles on a risk-adjusted basis over the long term (footnote).

Overview

Amun’s Ecosystem Index Tokens are composed of the top tokens in different crypto ecosystems. The Tokens provide holders with exposure to the leading projects of an ecosystem through either a native token or token launched by protocols on the chain..

A certain amount of the Ecosystem Index Token is comprised of the native token (i.e. MATIC for Polygon, SOL for Solana), providing holders exposure to both the chain's native asset plus promising projects built within the native asset's ecosystem.

Given the increasing number of chains gaining adoption, Ecosystem Index Tokens can grow to include a large number of additional constituent tokens.

Methodology

Constituent tokens are rebalanced on a monthly basis and are included in the index if they meet the Ecosystem Index Token inclusion criteria. To be included in the index, constituent tokens must be:

Native to the ecosystem

Launched over 60 days prior to inclusion

Gaining organic adoption

Listed on a chain's primary DEX with liquidity over $3M USD

Listed on Defi Llama with TVL data

Listed on CoinGecko with Market Capitalization data

Over $10,000 of liquidity in a single liquidity pool on the target chain

Exist for at least 2 months. This criterion will be measured by looking at liquidity pair creation dates in integrated DEXs.

Allocation Calculations Methodology

Step 1: Each underlying token is assigned its market cap based weight, except an ecosystem token (SOL for Solana, MATIC for Polygon, etc). A fixed weight of up to 50% is set to the ecosystem token. As ecosystems mature over time, we expect to lower the fixed weight of ecosystem tokens and make room for other promising projects.

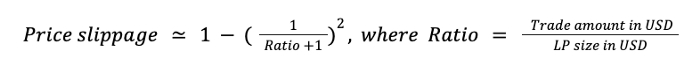

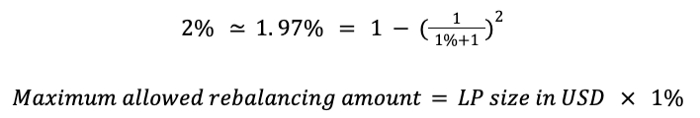

Step 2: Maximum Allowed Rebalancing Amount is the USD amount that any trade can be executed without incurring more than 2%. This amount is calculated from the liquidity pool size and a ratio of trade amount in USD to LP size in USD.

Based on this formula, to avoid price slippage greater than 2%, the trade amount cannot exceed 1% of the LP size.

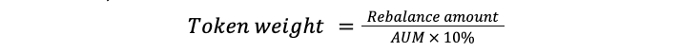

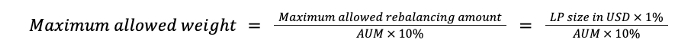

Step 3: At most, we assume 10% of the token’s market cap weight will be rebalanced during each rebalance. Using this assumption of 10% rebalancing amount and the Maximum Allowed Rebalancing Amount, we can calculate maximum allowed weight.

Rearranging the above formula;

After the substitution for the rebalance amount, the maximum allowed weight is simply;

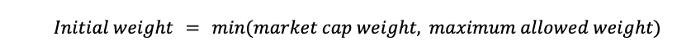

Step 4: For each token, Initial Weight is chosen to be the lesser of: 1) maximum allowed weight or 2) market cap based weight.

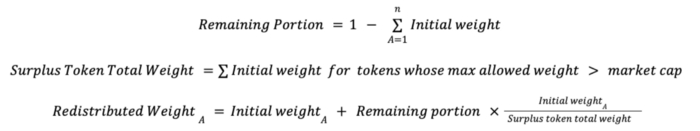

Step 5: Step 4 leads to a selection of weights where the sum of weights allocated may not add up to 100%. This is due to the presence of tokens whose maximum allowed weight is smaller than the market cap weight. The remaining portion of the portfolio is then recursively redistributed to the other tokens whose maximum allowed weight is higher than the market cap weight.

Step 6: The recursive redistribution from step 5 is repeated until all conditions are met and the portfolio weight sums up to 100%.

Fees

All tokens incur a management fee of 1.5% annually, which is waived for all token holders through the end of 2022

Last updated